Seattle’s payroll expense tax upheld by trial courtroom—time for employers to gear up for reporting

On June 4, 2021, King County Superior Court upheld the validity of the new Seattle payroll expense tax (dubbed the “JumpStart” tax) against a constitutional challenge. The tax came into effect January 1, 2021, but reporting for the first calendar year is not due until January 2022. Consequently, for employers who have put the necessary data-collection efforts on hold, it is time to think about how to capture the data and plan, if possible, for managing this tax liability.

The remote work environment of 2020-2021 makes it an especially challenging time to transition into this tax because of the multiple ways in which the tax base—”compensation paid in Seattle to employees”—is defined. To help covered employers better understand and address these challenges, this alert summarizes:

- The threshold payroll level that triggers the tax;

- The graduated rate structure;

- How “employees” is defined;

- What “compensation” is included in the tax computation;

- How the tax base “compensation paid in Seattle to employees” is defined:

- The hourly calculation; and

- The predominant service/residency calculation;

- Certain special industry treatments; and

- Restrictions on businesses’ ability to seek reimbursement of the tax.

Minimum Payroll Expense Threshold

No employer is subject to the tax in a given year if, in the prior calendar year, its “payroll expense”—i.e., the “compensation paid in Seattle to employees”—was less than $7 million. This threshold will be subject to an inflation index.

This threshold is technically established via an exemption from the tax. There is no minimum tax.

Graduated Rate Structure

Three different pairs of tax rates apply, depending on the employer’s “payroll expense.” The three tiers are:

- (1) Less than $100 million;

- (2) $100 million but less than $1 billion; and

- (3) $1 billion or greater.

For each of these employer tiers, there are also two employee-compensation tiers, with compensation at $150,000 to less than $400,000 taxed at one rate and compensation at or above $400,000 taxed at a higher rate. All of these thresholds will also be subject to an inflation index.

The City’s proposed amended rule contains this chart to show the payroll expense rates:

| Less than $100 million | $100 million but less than $1 billion | $1 billion or greater | |

| Annual compensation $0 – $149,999.99 | N/A | N/A | N/A |

| Annual compensation $150,000 – $399,999.99 | Rate = 0.7% (Seven-tenths percent) | Rate = 0.7% (Seven-tenths percent) | Rate = 1.4% (One and four-tenths percent) |

| Annual compensation $400,000 or more | Rate = 1.7% (One and seven-tenths percent) | Rate = 1.9% (One and nine-tenths percent) | Rate = 2.4% (Two and four-tenths percent) |

The City’s proposed amended rule also contains several examples for calculating the tax.

Who Is an “Employee?”

“Employee” captures not just common-law employees, or any other statutory concept of employees, but any individual who performs personal services or labor for a business. It includes owners of pass-through entities (LLCs, partnerships, S corporations) and sole proprietors.

It also includes individual independent contractors who perform services. The City Council’s target is no doubt large businesses that arrange for personal services delivered by individuals treated as non-employees (e.g., the ride-sharing industry), but the scope sweeps more broadly.

Taxable “Compensation”

“Compensation” is not limited to “Box 1” income for W-2 purposes. For regular employees, it is more akin to “Box 5” income subject to the Medicare tax because it includes employees’ contributions to retirement funds. But the concept is even broader than that and is critical because it bears on:

- (1) Whether the employer falls below the $7 million exemption threshold;

- (2) Which tax tier the employer falls within, if Seattle annual payroll exceeds $7 million; and

- (3) The amount of taxable compensation per “employee” whose compensation exceeds $150,000.

For regular employees, compensation has the same meaning as “remuneration” under the Washington Family and Medical Leave Program as defined in RCW 50A.05.010. The regulations of the Washington State Employment Security Department provide the principal guidance for the scope of compensation for regular employees. It includes salary and hourly wages, bonuses, commissions, cash value of earnings not paid in cash, paid time off, severance pay, stock grants (but not stock options), and employee contributions to retirement plans.

Compensation does not include tips, certain supplemental benefit payments, or employer contributions to benefits plans. The City’s regulation specifically identifies contributions to retirement and disability plans as excluded, but City staff have privately indicated that this exclusion also covers medical, dental, and life insurance plans. (Why they chose not to be explicit in the regulation is hard to understand.)

Because “employee” is defined broadly to include individuals who are owners of pass-through entities, “compensation” also captures net distributions and guaranteed payments made to such individuals to the extent “earned for services rendered or work performed.” “Compensation” does not include distributions from capital, investment income, or other passive-activity proceeds.

Because “employee” is also defined to capture individual independent contractors, the amount paid to such persons for personal services is also “compensation.” If a company also pays an individual independent contractor for goods that are subject to sales tax (such as materials provided by a construction contractor), presumptively those amounts would be excluded from “compensation.”

The Tax Base—”Compensation Paid in Seattle to Employees”

The city code provides two alternatives for determination of how much compensation is paid “in Seattle”: (1) an “hours” method, and (2) a method based on the predominant location of the employee’s work. The City’s regulation substantially modifies the code’s latter method in the interest of clarity and ease of administration. The business can apply only one method for each reporting year. (The method can be changed from year to year, but only, beginning in 2022, on the first quarterly return of the year; after that the method is fixed for the year.)

1. Hours Method

For employees who work exclusively in Seattle, this method allocates 100 percent of compensation to Seattle. For employees who work both within and outside Seattle in a year, this method requires an allocation of compensation on a ratio of hours worked in Seattle to total hours worked in a year. The regulation provides a presumption that 1,920 hours is a full-time employee’s hours-budget.

But if hours are greater than the 1,920 full-time presumption, the rule provides that “the employer must be able to document the increased number of actual hours for the calculation.” This provision works against the City, it seems, because if you have a known number of Seattle hours, an increase in total hours would just reduce the ratio of “compensation paid in Seattle.”

2. Predominant Service Method

The City’s rule calls the second option the “Primarily Assigned Method,” but this is a misnomer. Unlike the hours method, this method assigns compensation all-or-nothing to Seattle based on several factors.

The city code provides that 100 percent of the compensation paid to an employee “primarily assigned” to Seattle is “compensation paid in Seattle.” The code defines “primarily assigned” to be “the business location of the taxpayer where the employee performs their duties.”

On the surface, this might be read to mean that an employee is primarily assigned to Seattle if, as in the hours method, the employee works exclusively at a business location of the employer in Seattle, or that the business location in Seattle is the only business location of the employer where the employee works. But the City’s rule changes the definition to a 50 percent test.

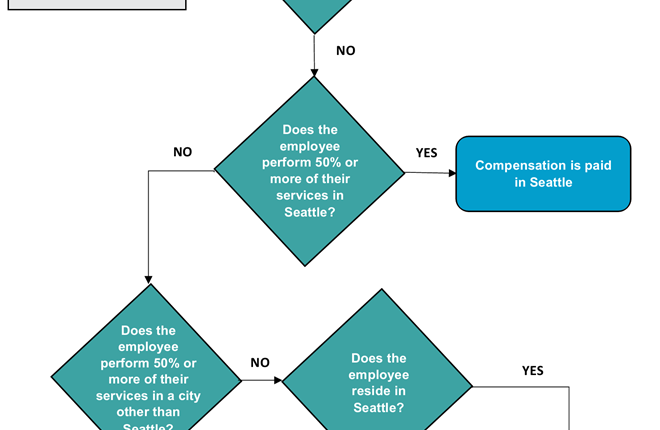

Under the rule, the following hierarchy applies. Compensation is paid in Seattle if:

- The employee works at a business location of the taxpayer more than 50 percent of the time in the year (this is the administrative version of the definition of “primarily assigned”);

- The employee, if not “primarily assigned” to any location, works cumulatively 50 percent or more of the time at any location in Seattle; or

- The employee, if not primarily assigned to any location, works less than 50 percent of the time in any city and is a resident of Seattle.T

The City’s rule provides a decision tree for determining whether an employee’s compensation is paid “in Seattle,” but it omits the critical issue of what “primarily assigned” means:

Keeping Track of Employee Performance of Services

The hours method was added to the tax code in a subsequent amendment and appears to meet the needs of employers that already track employee service on an hourly method. Probably few employers will create a new hourly reporting system to enable use of the hours method. Perhaps fewer would be able to recreate an hours database for calendar year 2020 so as to determine whether the $7 million exemption threshold would be available to them for 2021.

For most employers, the unusual conditions of the 2020-2021 pandemic and the prevalence of remote work create correspondingly unusual challenges in applying the predominant service method. Some of those challenges may include:

- Have employees been asked to report their work locations periodically or on a daily basis?

- Can the employer ask them to recreate location reporting after the fact?

- Are there in-office health-check records available to substantiate the days spent at employer business locations, whether inside or outside of Seattle?

- Ordinary office assignments made for human-resources purposes, or assignments made for allocating service for unemployment compensation tax purposes, do not align with the actual-service basis of the predominant service method.

- A primary focus in future audits may be determining the employee base residing in Seattle, because their HR assignments to a business location outside Seattle would not defeat allocating their compensation to Seattle unless the employer can prove they worked over 50 percent at the non-Seattle business location.

- The payroll function of employers may have no relationship with some independent-contractor hiring and payment, so coordination with the accounts payable function and identifying 1099 payments to individuals may be necessary.

Special Industry Treatments

Grocery Businesses

All “grocery businesses” are exempt from the tax. This class has two components:

- Retailers whose primary business is selling food and food ingredients to consumers that are exempt from Washington sales tax under the food exemption; and

- Wholesalers whose primary business is selling the same types of products at wholesale.

The “primary business” test is met if 70 percent or more of the gross income of the business is received from such sales, as determined for application of the City’s business license tax (B&O tax).

Non-profit Healthcare Entities

Non-profit healthcare entities have a three-year window, through 2023, in which they are exempt from tax on compensation paid to employees in the $150,000 to $399,999.99 range. For potentially qualified healthcare entities, it is best just to quote the definition (from SMC 5.38.020):

“Non-profit healthcare entity” means (a) a non-profit entity engaged primarily in the provision of comprehensive healthcare services, including primary and specialty care, and other non-profit healthcare entities that provide at least 50 percent of their services to patients covered by Apple Health and TRICARE, and to patients who have no third-party payor; (b) a non-profit entity that conducts life sciences research and development; or (c) a predominately capitated provider group within an integrated delivery system operated by a fully non-profit carrier licensed under chapter 48.44 or 48.46 RCW.

Other Exemptions

- Insurance carriers and their agents are exempt from the City’s business license tax.

- Fuel dealers, all of whose sales of fuel are exempt from the Washington state fuel tax under RCW 82.38.080.

- Business that sell only liquor products for which municipal taxation is preempted under RCW 66.08.120.

- Federal, state, and local government entities.

Restrictions on Reimbursement of Tax

The code specifically prohibits deducting the payroll expense tax from the compensation paid to the employee.

The code also states that the tax is not considered a tax on the business’s customers but shall be treated as an overhead cost of the business. This language has been interpreted in the B&O tax context to prohibit passing on the tax to customers as a separate “tax” line item—unless the business and customer expressly negotiate a “price” for the products or services that includes a segregated tax-reimbursement charge.