Paid Household and Medical Go away Authority budgets for pay raises

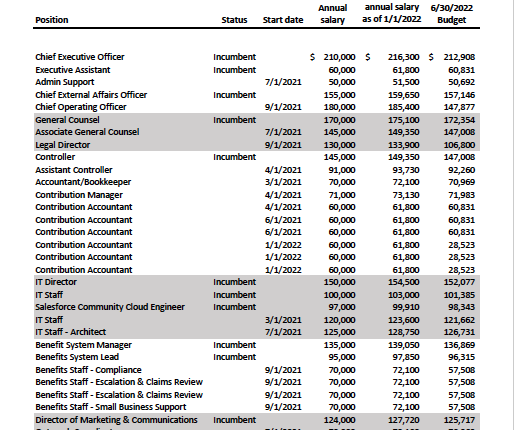

Connecticut’s Paid Family and Sick Leave Insurance Agency, which oversees the Paid Family and Sick Leave program, tabled a draft budget that includes a 3 percent increase for all employees from 2022, which is estimated to cost nearly $ 97,000.

The salary increases were set out in the agency’s draft budget presented at its finance and audit meeting on February 26th.

The PMFLI Authority’s program of paid family and sick leave is funded by a 0.5 percent wage tax on employees. When approved, these wage deductions help pay the increases for the agency’s 32 employees, many of whom earn more than six-digit years.

The PMFLI agency is a quasi-public agency that was established in 2019 when Governor Ned Lamont incorporated the paid family and sick leave program into law as part of his budget.

Number of employees with salaries from the budget of the PFMLI authority

Employees of the PFMLI authority are considered government employees and are therefore partly subject to collective agreements.

Andrea Barton Reeves, CEO of the CT Paid Leave Authority, said the draft budget was “designed to ensure that certain contingencies are taken into account, particularly the ability for the executive to negotiate increases for employees falling under collective bargaining agreements, when it will begin contract negotiations later this year. “

After two straight years of general wage increases and incremental increases for government employees, Lamont slipped another round of general wage increases from its proposed budget to save around $ 98 million over two years.

The State Employee Bargaining Agent Coalition responded to Lamont’s budget, calling it “deeply worrying” and saying it intends to negotiate “fair wages” and push for higher taxes for affluent Connecticut residents.

“Recognizing that wage increases can be a result of collective bargaining, the draft budget was designed to accommodate that potential outcome,” Reeves said.

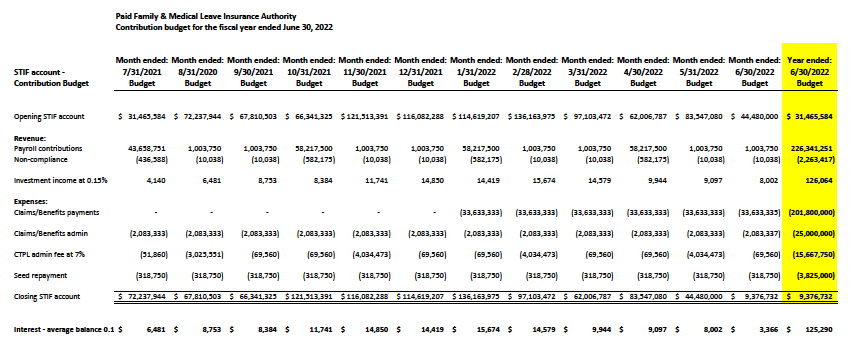

The PFML program was funded by a $ 25 million bond and will then be entirely dependent on employee wage deductions for continuing operations.

However, the agency’s expenses take into account how much money an applicant can receive. Under the Licensing Act, the benefits of the program rise and fall depending on how much the agency has raised and what the program administration costs are.

According to budget documents, the agency expects to take wage deductions of $ 201 million during fiscal 2021 and will spend $ 25 million on administrative costs and another $ 15.6 million on a 7 percent administrative fee .

The raise would coincide with the date that Connecticut residents can actually begin the paid vacation program. The program took a year to collect the wage deduction in order to have enough cash to start paying claims from 2022.

The program has got off to a rocky start, with more than 44,000 companies not deducting wages and even the state of Connecticut itself not collecting wage tax from non-union government employees due to a software problem.